Dubai

Dubai 183-Day Rule

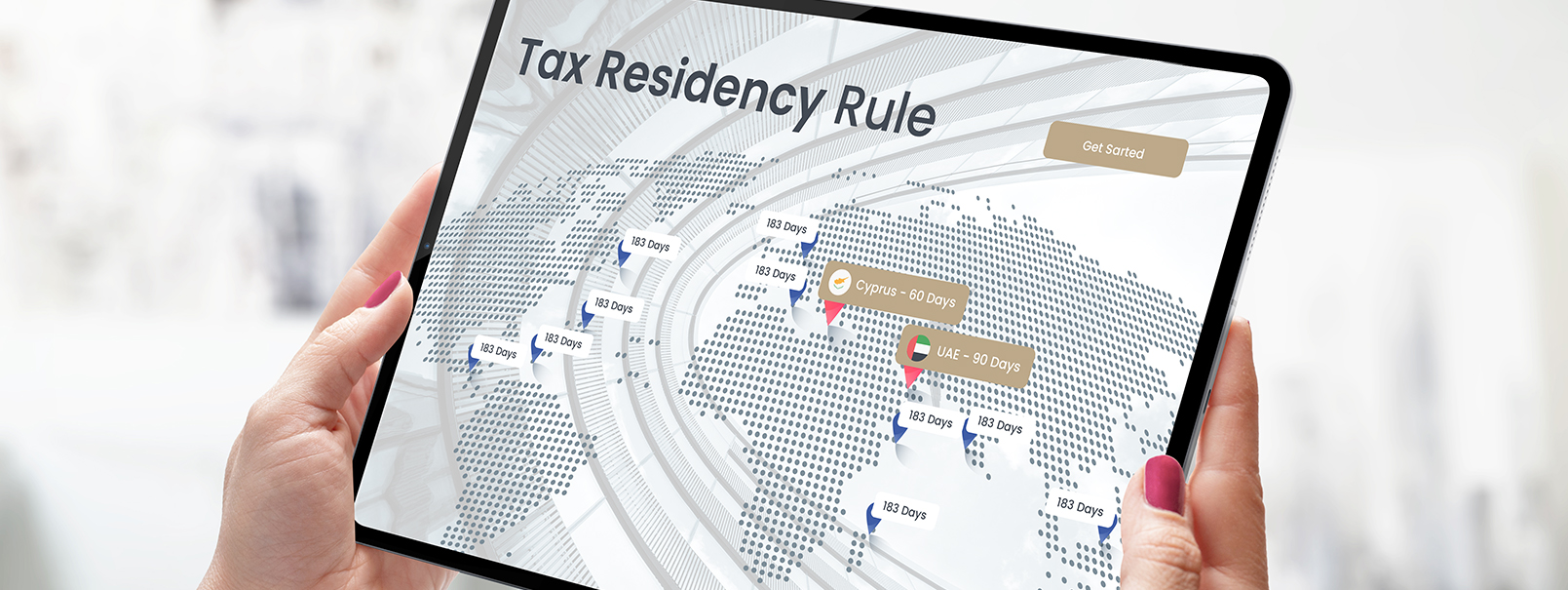

Previously, in Dubai and the entire UAE, there was only a so-called 183-Day Rule, which essentially stated: Anyone who stays in Dubai permanently and needs an official Tax Certificate to prove their tax residency had to have spent at least 183 days within the Emirates in the previous calendar year.

In 2023, the 183-Day Rule in the UAE was supplemented by an additional applicable 90-Day Rule. The minimum stay required for national tax residency has thus been reduced from 183 days to 90 days per calendar year.

The Importance of a Dubai Tax Certificate (UAE)

A tax certificate, in simplified terms, is an official document confirming that a legal entity or natural person holds a legal tax status domestically and contributes taxes to the public budget. Thus, it proves on a national level the tax residency within the United Arab Emirates.

90-Day Minimum Stay in Dubai

Although Dubai does not tax the personal income of a resident, making the income of an individual living in Dubai tax-free in the UAE, the Ministry of Finance issues a nationally recognized tax certificate upon request after a minimum stay of just 90 days.

In Dubai, two rules apply: 90 days and 183 days. Establishing tax residency in Dubai means, among other things, deregistering your previous residence in Europe or wherever you were liable to income tax. This is the only option for becoming a tax resident in Dubai and other emirates of the UAE. The 183-Day Rule in the UAE.

The 183-Day Rule in the United Arab Emirates

Unlike the national tax certificate, which can be applied for after just 90 days of stay in the UAE, the international tax certificate requires a minimum stay of 183 days in the UAE. The value of a so-called international tax certificate can be illustrated through two brief examples:

An example represents the possibility of reassessment upon return to the “old home.” While this occurs only under special circumstances and can be avoided through careful preparation, why choose the difficult path when there’s an uncomplicated alternative? Holding a tax certificate puts you on the safe side.

Especially banks can demand official proof of their customers’ tax residency. The presentation of your UAE tax certificate can thus help to avoid unnecessary effort.

Applying for a Tax Certificate in the UAE

The application for your tax certificate in the UAE is primarily done online and can be completed within about 30 minutes, provided you meet the following requirements:

- On the day of application, you have been in possession of a valid residence permit for the United Arab Emirates for longer than 180 days (national tax certificate) or 365 days (international tax certificate).

- Within the past 12 months or within the current calendar year, you have spent more than 90 days / 183 days in Dubai or another emirate of the UAE.

- Your residence is located within the United Arab Emirates, and you possess a valid UAE Residence Visa as well as an Emirates ID.

- You own a residential property within the UAE (purchase proof: title deed or have permanently) rented for personal use (proof: Ejari registered lease agreement).

- You hold a personal account and and bank statements of which you can present from the past six months.

Dubai Offers You Maximum Flexibility

The 90-day rule / 183-day rule in Dubai and the UAE does not constitute a mandatory requirement for obtaining or maintaining a residence permit in the Emirates.

To avoid jeopardizing the validity of the granted residence, visa, the holder, depending on the visa type, depending on the visa type, should not stay outside the United Arab Emirates for more than 182/365 consecutive days.

Applying for a personal tax certificate in the United Arab Emirates is not mandatory for residents!

Proof of Tax Residency in Dubai

60-Day Rule in Cyprus (EU)

Dubai and the United Arab Emirates are in direct competition with the EU member state Cyprus and the Principality of Monaco, with the latter having apparently lost considerable attractiveness in recent years.

Cyprus, on the other hand, is an EU member state, possesses various tax benefits for individuals and businesses similar to Dubai, and also offers a 60-day rule for the international tax certificate instead of a 183-day rule.

Which country ultimately represents the absolute optimum for you as an expatriate, entrepreneur, and/or digital nomad depends, among other things, on many individual aspects.

Let’s talk about your plans now. Our experts are available for a personal and free consultation.

We are happy to assist!

for a free consultation

with one of our experts

– Flexibel. Wirtschaftlich. International.vg)